A big fear of many Etsy sellers and other online businesses is taxes. And in this article, we’re talking about sales tax, specifically.

Taxes, in general, is a big fear-driven topic as the average person. Us average Joe’s and Josette’s, you and me, don’t typically understand a whole heck of a lot about taxes. (Schools need to teach more about taxes and personal finance in school, just my personal opinion.) And usually even less about sales tax other than we usually have to pay it when we buy something.

BUT HAVE NO FEAR!!!

Just a heads up! This blog post may contain affiliate links. If you make a purchase through a link, I make a commission from your purchase. This is at no additional cost to you. This helps me provide this content to you!

Wait… No one’s coming to save me?

You, unfortunately, have to do the work here. You need to understand not only your federal laws, but also, your state, county and even city and municipality laws regarding sales tax collection and the remittance process.

Note that there is a difference between collecting sales tax from a buyer for a sale, transaction or order and remitting the sales tax (paying sales tax due from that transaction to the correct tax jurisdiction).

You may even be part of a special district with an additional special tax rate.

Ask me how I know…

I fall in this category, myself, with a special ambulance district sales tax rate.

Collecting Sales Tax On Etsy

Many Etsy sellers are frustrating and confusing trying to figure out if sales tax is collected by Etsy. And then figure out how to remit it properly or whether this is the responsibility of the business owner, you.

As a general rule, Etsy is now being required by law to handle the sales tax collection and remittance on the Etsy seller’s behalf.

New laws have been enacted regarding online marketplace selling platforms to help with the online sales taxation process, collection and remittance of sales tax to the correct state or jurisdiction.

Most states, at this point, have now revamped their laws regarding online marketplace transactions and how to account for sales tax.

As Etsy is part of the online marketplace category, according to current government laws in the United States, most of the sales tax process may fall on Etsy’s shoulders.

If you have an interest in learning more about how and why some of these online sales tax rules are changing, check out this article by CNBC.

Changing Regulations

Each year, a few more states jump on the sales tax reform bandwagon. Finally, states are getting it together regarding online sales and e-commerce businesses, sales tax-wise. This helps us small business owners and big businesses, alike. The more things are streamlined and on the same page, the less confused by this whole process we’ll be.

States are making these changes so they get that sales tax revenue. They had previously not been receiving much of the sales tax due from online businesses under previous sales tax laws.

We have to remember that at this point in time, e-commerce is really still just a baby and getting its footing and trying not to fall too many times in the process.

According to Statista.com, in 2022, $789.01 billion in U.S. dollars was generated from the e-commerce industry.

We’re seeing more and more headlines like this one from Boston Consulting Group.

Online business laws will continue to change over time and we need to be prepared.

The process is getting better, but I wouldn’t get my hopes up for some unified, nationwide tax code any time soon. That probably won’t happen.

So… it’s your job, as a business owner, to make sure you are following the most updated laws that affect your business. And it will take some work to get it all straight and keep it all straight.

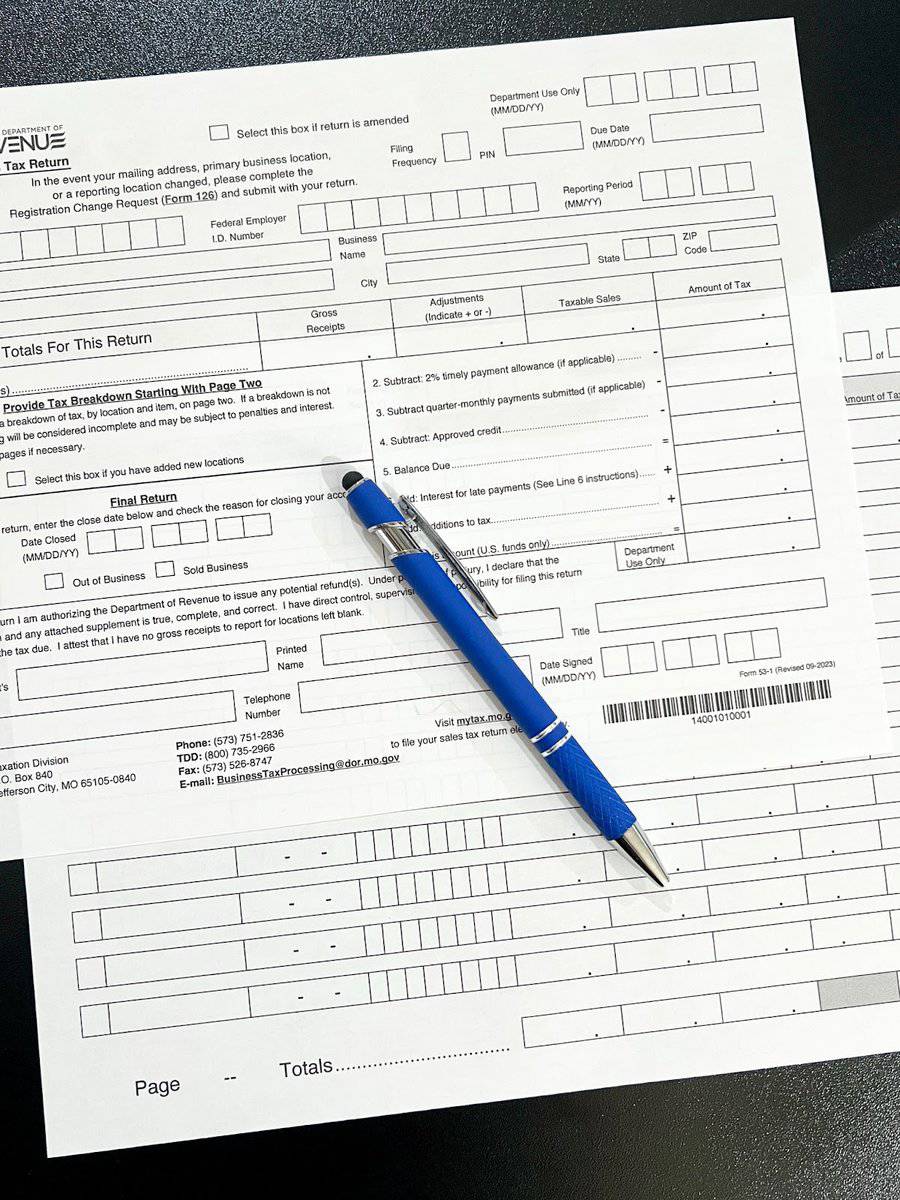

Missouri Sales Tax Laws

If you happen to be a Missouri resident, like me, and sell on marketplaces like Etsy and Amazon Handmade, you may find these websites particularly helpful regarding sales tax.

Missouri Department of Revenue – Remote Seller and Marketplace Facilitator FAQs

This page on the Missouri’s Department of Revenue website, specifically, talks about Remote Sellers and Marketplace facilitators and how this may apply to your online business.

Missouri Department of Revenue – My Tax Missouri

If you find out that you are, in fact, needing to remit sales tax not remitted already for you in Missouri, you can set up an account, file your sales tax return and remit any due sales tax here.

These two pages alone are a gold mine of information for businesses in Missouri.

For Etsy sellers who are living in other states in the U.S., I’ve put together this list of each state’s Department of Revenue that you can quickly reference and check out the sales tax laws in your state.

Department of Revenue by State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Massachusetts

- Maine

- Maryland

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Sales Tax Rate Charts

I do want to also make note that most states, counties, etc., have a chart of current sales tax rates you can reference, but may have to do some digging or call your local county Collector of Revenue’s office to get a physical or emailed copy to you if not available on your state’s DOR website.

These sales tax rate charts may be helpful if you do the occasional popup shop, flea market event, craft show, etc. as these would not fall into sales that Etsy would collect sales tax for you since these transactions didn’t occur online through its platform, therefore, you would need to collect and remit yourself.

Needless to say, if ever in doubt, call in a tax lawyer or accountant.

As I’m not a lawyer nor a licensed accountant, and I definitely don’t play one on tv or the internet either. Talk to a professional in the field when needed.

At least once a year, usually during tax season, I call or email our accountant with some new questions about recent changes to the business tax laws. It’s okay to ask for help.

It’s your job to legally run your business, even if that means bringing in the big guns of a lawyer or accountant sometimes. And if they aren’t sure, go to your state’s government website or local collector of revenue’s office and find the answer.

Should I be collecting sales tax in my Etsy shop?

You need to collect sales tax when you make sales online, in most cases. There are several instances where you nor Etsy are required to collect sales tax though.

Your business will be responsible for collecting sales tax, remitting sales tax to the proper tax authority, and filing a sales tax return form for your online income for transactions in which it isn’t being collected and remitted for you.

All of this is state dependent though. In some states, sales tax is only required to be collected on the sale of physical items. In other states, both physical and digital items are both taxed. And in some cases, only specific types of products within each of these categories require sales tax.

There is also usually a bit of legal jargon thrown into these classifications such as the sale of tangible, personal property, etc. so you need to pay special attention to the wording of the Department of Revenue’s (DOR) guidance and definitions.

See how this is confusing?!?

What happens if I don’t collect and remit sales tax correctly?

There are steep penalties for not properly collecting and remitting sales tax in accordance with sales tax laws.

These penalties could be no more than a small fine on top of the balance due, but could also incur thousands of dollars in interest on the balance due over the course of time the balance remains unpaid, depending on the situation, state, etc.

It will hurt your pocket book far more later if you don’t learn to do it correctly now. No one wants to find out they should have been collecting and remitting sales tax and didn’t, then get a huge bill, with interest, later on.

Luckily, with the help of the internet, marketplace law changes, some accounting software and better government websites, much of this process can and is done electronically now and taken care of by the marketplace you sell on.

Saving you a lot of headaches.

But the process can be daunting and confusing the first few go-a-rounds. Especially while these laws are still being developed and changing.

But, the good news here is that the laws around online sales and e-commerce are getting better, becoming more commonplace and widely understood, be it marginally… slowly… and sometimes painstakingly.

Does Etsy Collect Sales Tax For Me?

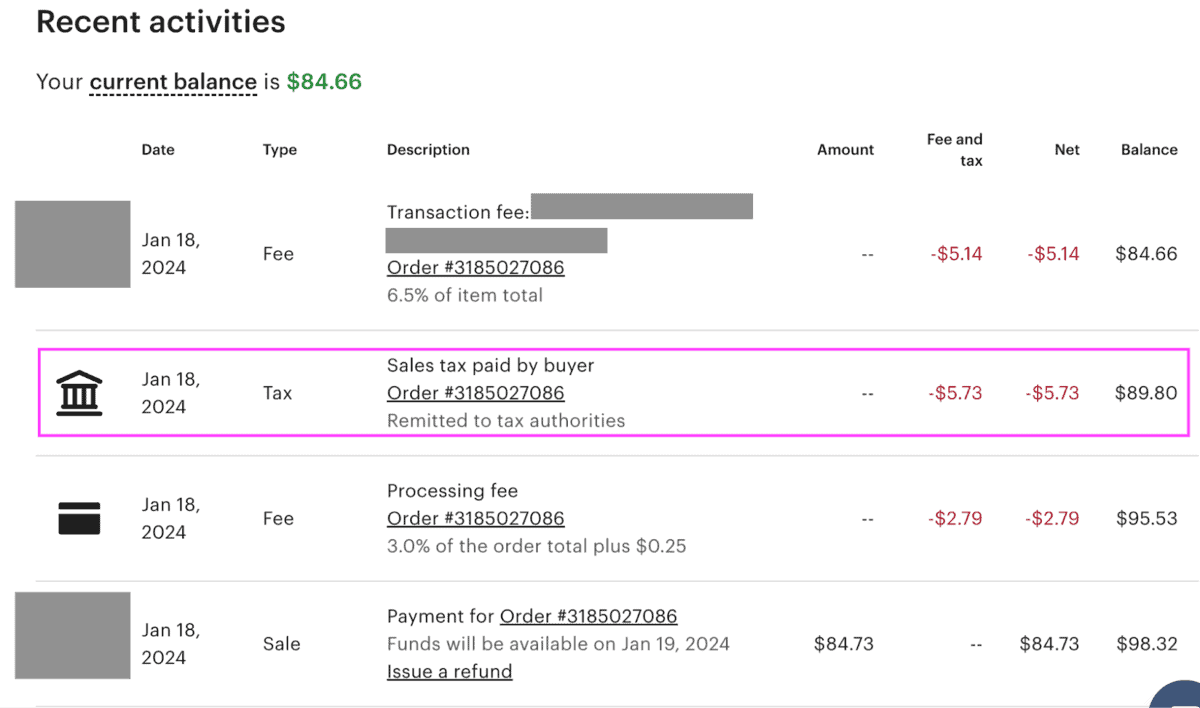

You can easily see which transactions Etsy collects sales tax on.

To see if Etsy is collecting and remitting sales tax for you, check the Payment Account page under the Finances tab on your Etsy Seller Dashboard. Then see Recent Activities. In this section of the page, you can see if you have sales in which Etsy collected and remitted the sales tax for you.

It will look a little something like this…

Under the section Recent Activities, you can see that we had a sale in which the buyer paid sales tax, and Etsy remitted that tax to the proper tax authority.

Etsy used to have a page on their site that had an updated list of which states it did this for, but it looks like Etsy hasn’t updated the page ( or I would normally reference it here) since circa 2021 so… just give Etsy support a shout if you aren’t sure.

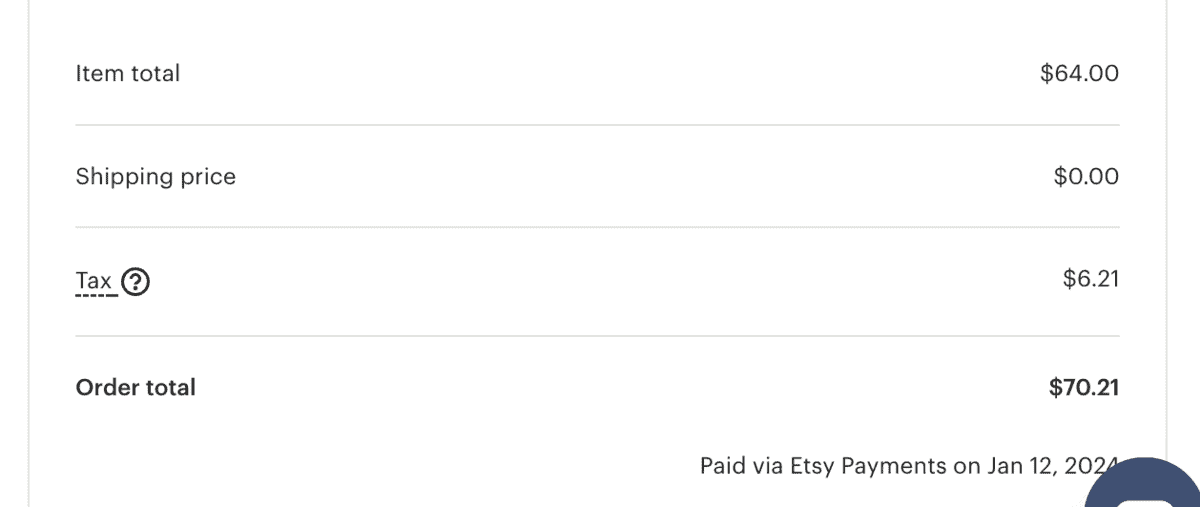

You can also see if Etsy collected sales tax on your order receipts.

It will look like this.

Here, Etsy has charged the buyer sales tax on this order.

Also, remember that Etsy may not be required by law to collect sales tax on all transactions, like we were discussing before in the case of items such as digital items and also that not all states charge sales tax on certain physical products either.

Sales Tax Remittance To Multiple States

To all my Ninja Etsy sellers out there…

If you are really raking in the dough with your Etsy shop, you may need to file a sales tax return and remit sales tax to more than one state so do double check these laws to see if you’ve met the income threshold requirements.

Make sure you’ve covered the sales tax bases to cover your butt. No one wants to see that tax bill later.

If you still have questions about whether Etsy is remitting the sales tax for your shop or to check to see if your state is now on Etsy’s list of states that it does collect and remit sales tax for, you can reach out to Etsy support directly as well to ask if Etsy is collecting and remitting sales tax for your shop to your state or if you are responsible for collecting and remitting the sales tax or any other questions regarding sales tax.

What happens if Etsy doesn’t collect sales tax for your Etsy shop?

Etsy may not be required to collect sales tax on all sales on the marketplace platform. As we were discussing before, not all transactions are required to collect sales tax under current sales tax laws.

If Etsy is not collecting sales tax, you need to look into why Etsy isn’t collecting sales tax if you believe this in error. But it could simply be that Etsy isn’t required to collect sales tax on digital downloads for your particular state in the example of digital product seller.

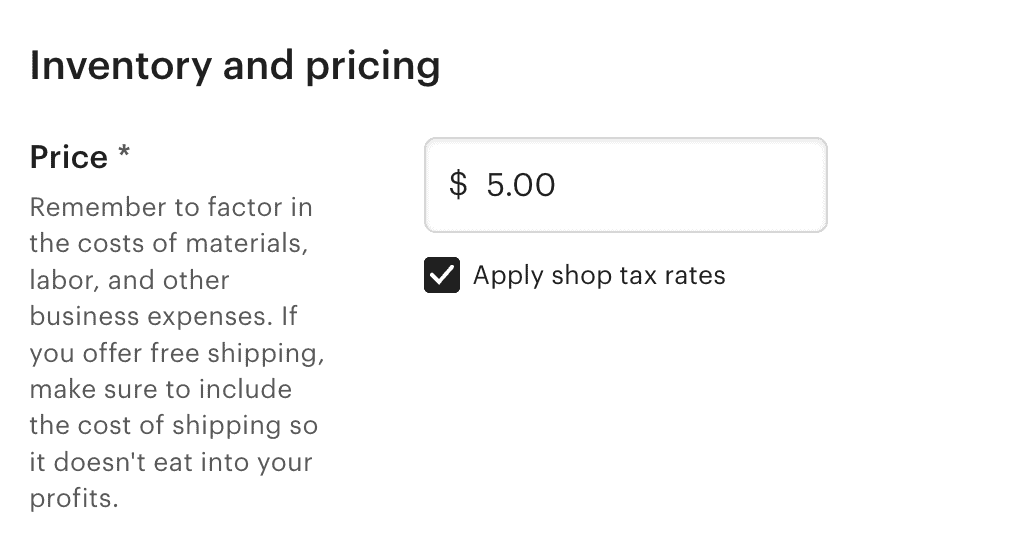

In the older version of Etsy’s listing screens, you had a place where you could toggle on or off if sales tax was to be collected on that item.

In the newer version of Etsy’s listing screens, I’m no longer seeing this as an option, and this may be due to Etsy using things like physical or digital items categories, whether shipping is needed, etc. to determine if sales tax should be collected or should not be collected for that item.

Best Accounting Software For Etsy Sellers

As you may know I sell on multiple platforms with multiple businesses. I use Quickbooks Self-Employed, personally, for all our business needs. I would recommend Quickbooks for most Etsy sellers.

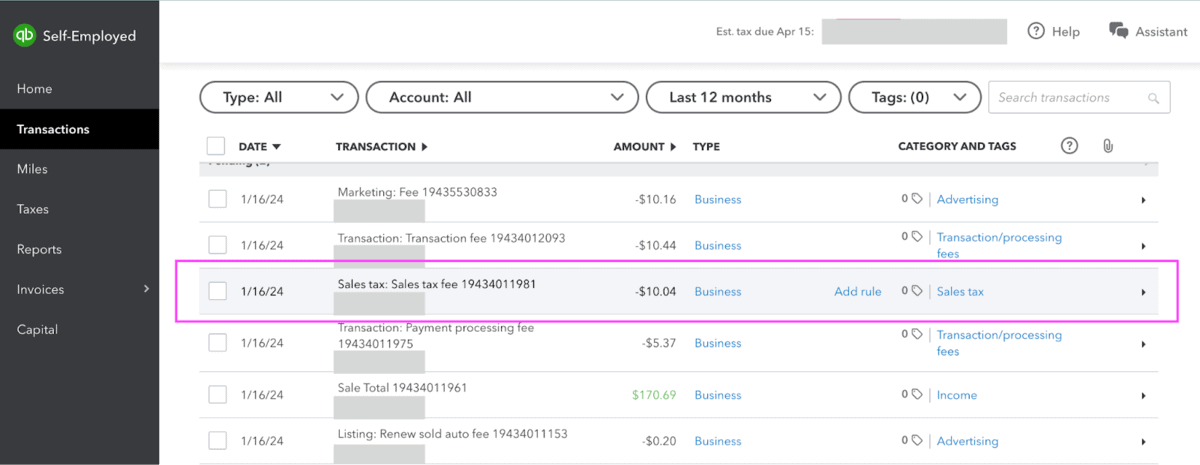

If you are using an accounting software like Quickbooks, you can see where sales tax is being or not being collected and remitted for each transaction as well.

The sales tax was collected for this particular sale, reflected in the Sale Total, then remitted in the Sales Tax section I highlighted.

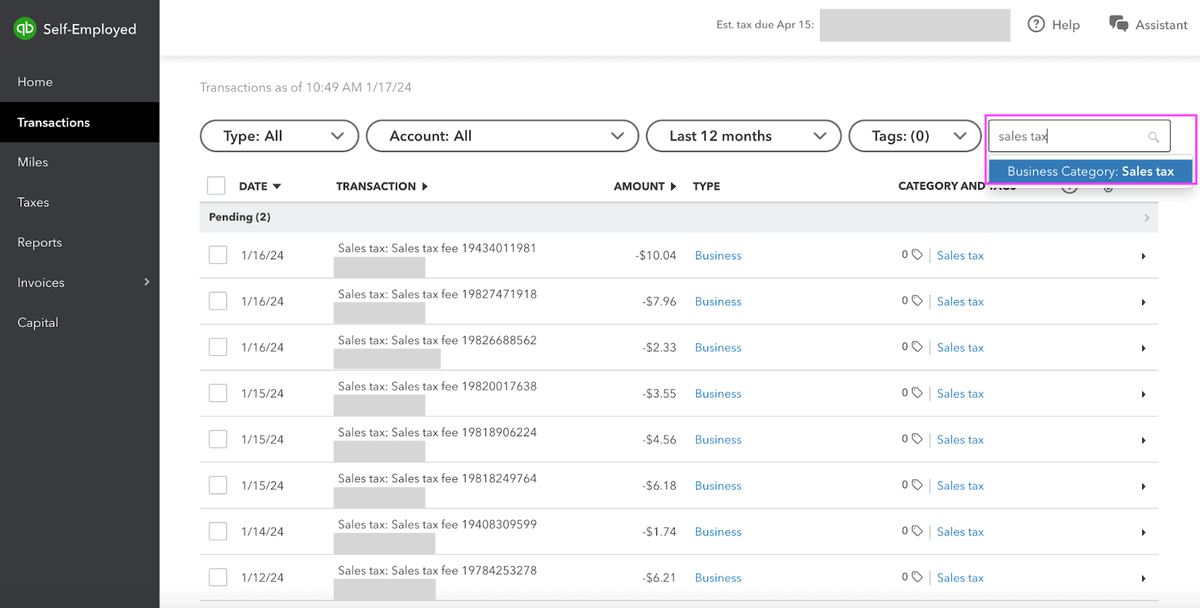

You can also see in Quickbooks Self-Employed all the sales tax collected by Etsy by just adding a filter in the search transactions field like this.

Word of Caution with online accounting software – Quickbooks in particular scenario.

There are several types of online Quickbooks accounts to choose from, so if you go this route, make sure you choose the one that fits your business’s needs, like if you have stores on multiple platforms, types of bank accounts you have, brick and mortar versus online shops, etc. Not all plans have the same features and functionality.

There are several online accounting solutions, Quickbooks just happens to be the one I use. Do your research and pick one that’s right for you.

When do I need to file my sales tax return?

Also, when do I need to remit my business sales tax collected?

To add more confusion to the sales tax topic, sales tax returns and collected monies need to be remitted by specific dates each year.

Refer to your state’s Department of Revenue to see what the due dates are for filing a sales tax return form and remitting the sales tax collected from your business’s sales.

You can reference those links above for the United States Department of Revenue by state list. You may need to file only once a year or you may beed to file quarterly or even monthly depending on your business’s situation and state.

PHEW!

Remember, that if you ever suspect that Etsy isn’t collecting sales tax and should be or it just doesn’t seem correct, feel free to get on the phone or chat or tech support at Etsy to get clarification.

If Etsy is collecting and remitting the sales tax, then GO YOU!!! But again, remember that you may still be on the hook to remit the sales tax to your state or other states and to file a sales tax return even though Etsy may be collecting the sales tax for you if Etsy isn’t remitting the sales tax.

And you can always check with your local tax authority or accountant to see what your next course of action should be when questions arise.

Are you thinking about starting your own Etsy shop?? Use this link to get 40 FREE listing credits!!

Getting started selling on Etsy is fairly easy.

To learn more about what you can sell on Etsy, check out this article next.

And also 121 products you can make and sell on Etsy.

Or if you’d like to learn more about Etsy’s seller fees, this article is for you.

Don’t forget to request to join the FREE Facebook Group and drop your email in the Subscribe box for more Etsy shop goodies.

Ready to start an Etsy Shop? Get started today with 40 FREE listings!